Tax Calculation for Multi-Address Checkouts in the United States

Giftship’s multiple shipping address functionality allows taxes to be calculated in the same manner as a single address checkout. However, if you charge sales tax in the United States, you will need to configure your nexus states within Giftship’s admin dashboard.

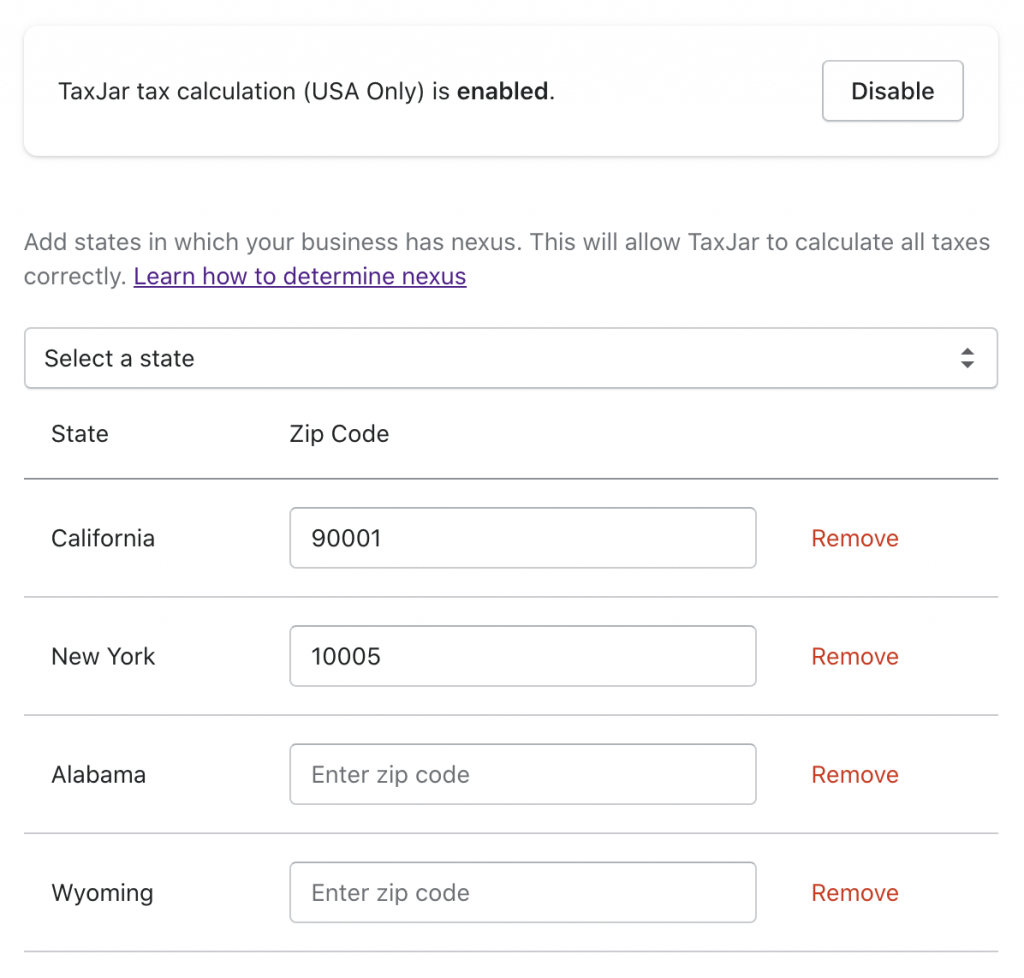

Giftship leverages the TaxJar API to apply accurate US tax rates.

To get started, navigate to Shopify Admin -> Apps -> Giftship -> “Shipping to Multiple Adddresses”, and scroll to the section titled “Tax Calculation”.

For each state in which you have physical or economic nexus, select the state from the dropdown, and, if applicable, enter the zip code for you physical nexus location.

These values should match what you have configured in you Shopify tax settings for the United States.

Can't find the answer in our documentation?

Contact Support Edit Gift Messages etc on Multiship and Cart Page in Giftship

Fulfilling Multiple Shipping Address Orders

Viewing Reports with Multiple Shipping Address Orders

Discount Codes for Multiple Shipping Address Orders

Tax Calculation for Multi-Address Checkouts in the United States

Conditionally Hide Giftship Options Based on Your Carts Contents

Sending non-physical products to multiple recipients

Using Tax Overrides for Multiple Address Checkouts

Enable Order Notes for Shipping to Multiple Addresses

Making the Multiple Shipping Address Checkout Cart the Default

Selling Digital Gift Cards with the Multiple Shipping Address Process

Shopify Plus: Configuring Avalara to Honour Shopify’s Tax Settings